What is Composite Supply?

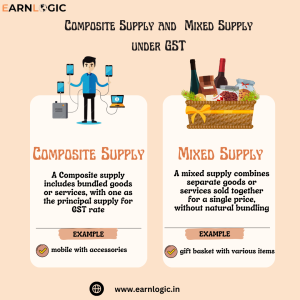

A Composite Supply refers to a combination of two or more taxable goods or services that are naturally bundled together and supplied in the ordinary course of business. In such cases, one of the goods or services is considered the principal supply, while the others are ancillary or supplementary.

Key Characteristics of Composite Supply:

- Natural Bundling: The goods or services are naturally bundled and typically sold together as a package. This could be due to consumer demand, industry practices, or inherent business processes.

- Principal Supply: One of the items is the dominant or main component of the supply, and the others are supplementary to it.

- Single Tax Rate: The GST rate applied to the entire composite supply is based on the rate of the principal supply, regardless of the tax rate of the ancillary items.

Example of Composite Supply:

What is Mixed Supply?

Key Characteristics of Mixed Supply:

- Non-Natural Bundling:The seller does not bundle the goods or services out of natural necessity or business practice. The seller can sell the items separately.

- Separate Goods or Services: The seller can independently supply each item in the bundle.

- Highest Tax Rate: The tax authority taxes the entire supply at the highest GST rate applicable to any individual component within the bundle.

Example of Mixed Supply:

Distinguishing Between Composite Supply and Mixed Supply

While both involve bundling goods or services, there are significant differences between the two:

- Nature of Bundling: Sellers bundle composite supplies together naturally in the ordinary course of business (e.g., a car with its battery), while they combine mixed supplies for sale convenience or promotional reasons (e.g., a bundle of different household items).

- Tax Implication: The GST treatment differs significantly:

- In Composite Supply, the tax rate is based on the principal supply, which reflects the predominant element of the bundle.

- In Mixed Supply, the highest applicable tax rate of any individual item in the bundle applies to the entire supply.

- Business Impact: Businesses need to understand these differences to apply the correct GST rate, avoid errors in invoicing, and ensure compliance. Misclassification of a composite supply as a mixed supply (or vice versa) could result in tax miscalculations.

Real-World Examples for Clarity

- Composite Supply Example:

-

- Mixed Supply Example:

Conclusion