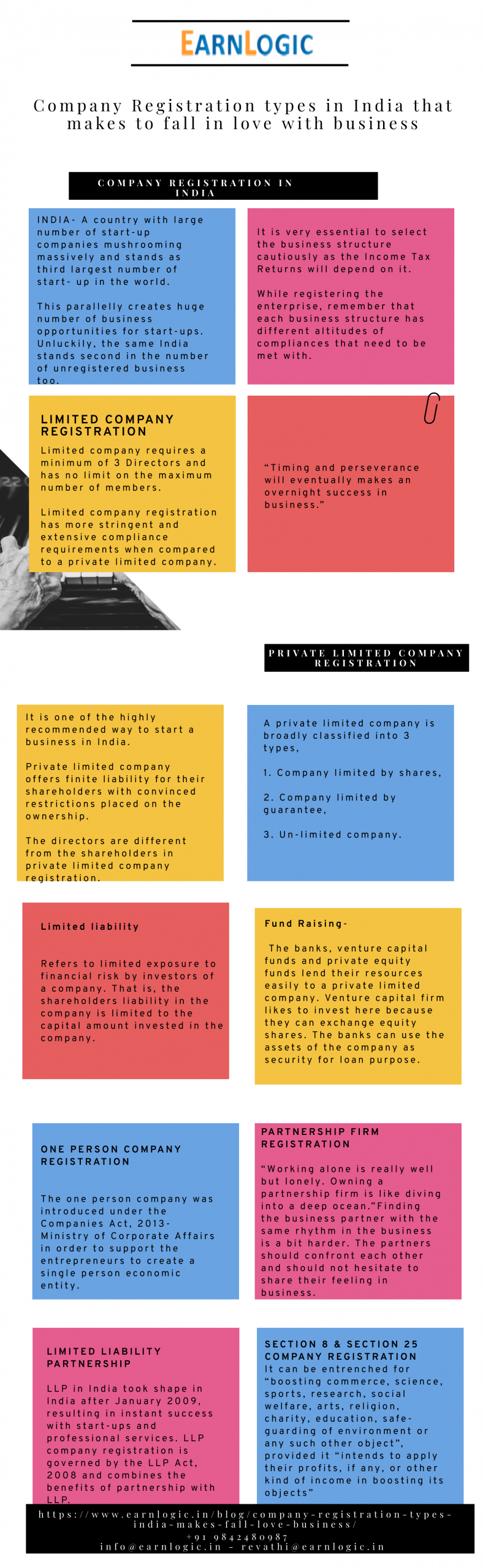

COMPANY REGISTRATION IN INDIA

BANGALORE- “The hub of different types of company registration” and a city with large number of start-up companies mushrooming massively and stands as third largest number of start- up in the world. This parallelly creates huge number of business opportunities for start-ups. Unluckily, the same India stands second in the number of unregistered business too. Registering a company is relatively easy and a stress free feel that proposes legal protection to the businessmen. Registered company can be operated effectively and enthusiastically. Company registration under a right business structure is important that will allow the enterprise to operate efficiently and meet the required business targets.

Every company must register themselves as a part of mandatory legal compliance. It is very essential to select the business structure cautiously as the Income Tax Returns will depend on it. While registering the enterprise, remember that each business structure has different altitudes of compliances that need to be met with. For instance, a sole proprietor has to file only an income tax return but, a company has to file an income tax return as well as annual returns with the registrar of companies.

LIMITED COMPANY REGISTRATION

Limited company requires a minimum of 3 Directors and has no limit on the maximum number of members. It’s better to form a limited company and divide the shares equally. By setting up a Limited Company, business people could protect assets which were effectively beyond those declared as assets of the company being formed. Any loss is limited to the issued share capital of that particular investment. Limited company registration has more stringent and extensive compliance requirements when compared to a private limited company It is a type of business structure whereby a company is considered a legally distinct body.

To set up a limited company, you need to register with Companies House –which is called as company incorporation. We can either do this by self or by paying an accountant or solicitor to go through the process on your behalf. When registering, you need to provide: the complete registered name and address of the company, the directors, the secretary, details of shareholders and capital.

“Timing and perseverance will eventually makes an overnight success in business.”

PRIVATE LIMITED COMPANY REGISTRATION

It is one of the high recommend way to start a business in India. Private limited company offers finite liability for their shareholders with convinced restrictions placed on the ownership. The directors are different from the shareholders in private limited company registration. It can have a minimum of 2 member and maximum of 200 member. Also, it must have a minimum of 2 director and a maximum of 15 director. This company holds 40% legal entity in India. A private limited company is broadly classified into 3 types, Company limited by shares, Company limited by guarantee, Un-limited company. The advantages of private limited companies are business continuity, limited liability and fund raising.

Limited liability

refers to limited exposure to financial risk by investors of a company. That is, the shareholders liability in the company is limit to the capital amount investment in the company. For example, if Ram invests Rs.1 LAKH to start a private limited company, his potential loss cannot be beyond Rs.1 LAKH. He won’t be liable for any liability beyond this initial amount of 1 lakh.

Business continuity

The shareholders may come and go since, the company is unaffect even in case of death of any shareholders. So that the private company enjoys perpetual succession.

Fund Raising

The banks, venture capital funds and private equity funds lend their resources easily to a private limited company. Venture capital firm likes to invest here because they can exchange equity shares. The banks can use the assets of the company as security for loan purpose. The private limited company can be easily sold to others without affecting any activities of the company.

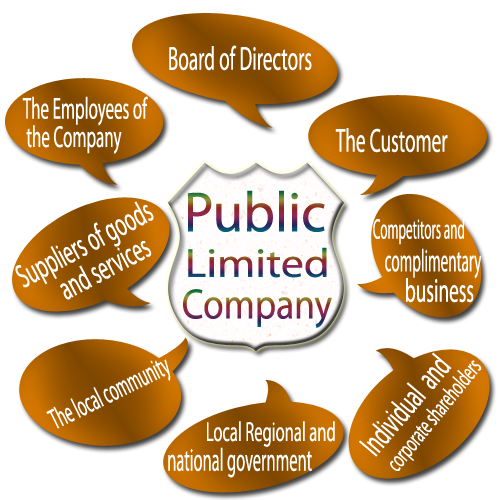

PUBLIC LIMITED COMPANY REGISTRATION

A Public Limited Company is a voluntary association of members which is registered under company law. It has an individual legal existence and the liability of its members are limited to shares they hold.

One can choose what business structure suits their business needs and accordingly register their business. Public limited company registration is the legal destination of LLP that has offered shares to the general public and has limited liability. The stock of the PLC is issue to the general public and can be acquire by anyone, either privately, during an initial public offering or through trades on the stock market that has issued shares to the general public and has limited liability.

A PLC’s stock is offered to the general public and can be captured by anyone, either secretly, during an initial public offering or through commerce in the stock market. PLC’s registration can either be listed or unlisted in a stock exchange. Similarly, like any other major entity, PLC is stringently coordinated and enforced to publish their original financial health so shareholders can size up the true worth of their stock. The total life span of a Public Limited Company is not determined by the death of a shareholder.

ONE PERSON COMPANY REGISTRATION

The one person company is under the Companies Act, 2013- Ministry of Corporate Affairs in order to support the entrepreneurs to create a single person economic entity. One of the greatest leverage of OPC is that only 2 members requirement for company registration and maintenance. An OPC is a separate legal entity which will offer limited liability protection to its shareholders and also easy to incorporate. The business under OPC registration can run without any worries on litigations and liabilities getting attach to the personal assets. OPC was recently introduced in the year 2013 and is the best way to start a company if there exists only one promoter or owner. It empowers a sole-proprietor to carry on his work and still be part of the corporate framework.

OPC- a game changer led to the recognition of a completely new way of starting businesses that accorded flexibility which a company form of entity can offer, while also providing the protection of limited liability that sole proprietorship or partnerships lacked. Section 2(62) of Companies Act defines a one-person company as a company that has only one person as to its member. Furthermore, members of a company are subscribers to its memorandum of association. Generally, such companies are created when there is only 1 founder or promoter for the business. Entrepreneurs whose businesses lie in early stages prefer to create OPCs instead of sole proprietorship business because of the several leverages that OPCs offer.

Difference between OPCs and Sole Proprietorships

A sole proprietorship form of business might seem very similar to one-person companies because they both involve a single person owning the business, but they’re actually exist some major differences between them. The main difference between the two is the nature of the liabilities they carry. Since an OPC is a separate legal entity determine from its promoter, it has its own assets and liabilities. The promoter is not personally liable to repay the debts of the company. On the other hand, sole proprietorships and their proprietors are the same persons. So, the law allows attachment and sale of promoters own assets in case of non-fulfilment of the business liabilities.

“Reputation is more important than the pay check, and integrity is worth more than career in a sole proprietorship.”

PARTNERSHIP FIRM REGISTRATION

Some of the tools to stay afloat in this partnership ocean are namely small start, talent & right partner identification, making introduction, getting clear vision, taking ownership, staying flexible, listening for feed backs and having fun. Business partners are the persons who help the venture that is struggling to maintain the leads in a steady manner and thereby giving hands as a partner which finally results in unexpected growth development and opportunities. Partnership speeds up the business growth and possible only by potential and perfect business collaborators and collaboration. Partnership firm that is without registrar of firms – 30% and partnership firm with the registrar of firms – very less after the LLP.

Finding the business partner with the same rhythm in the business is a bit harder. The partners should confront each other and should not hesitate to share their feeling in business. Excessive communication between partners helps in motivation. Each partner should have unique role and it is best to follow divide and conquer method.

“Achieve your goals by creating a happy partnership.” “Working alone is really well but lonely. Owning a partnership firm is like diving into a deep ocean.”

“It takes time to create a perfect partnership. Personal life goals should not affect the partnership. The life goals of both the partners should be similar and mutually aligned. ”

LIMITED LIABILITY PARTNERSHIP

LLP in India took shape in India after January 2009, resulting in instant success with start-ups and professional services. LLP company registration is govern by the LLP Act, 2008 and combines the benefits of partnership with LLP. It is also a separate legal entity and easy to maintain. Even transferring the ownership is very simple. It is an alternative corporate business form which offers the benefits of limited liability to the partners at low compliance costs. A person can instantly be induct as a designated partner, so the ownership switches to them. It has partners, who own and manage the business. This is contrast from a private company, in which the directors may differ from shareholders.

For the above logic, the VCs do not invest in the LLP framework. It is a mixture of private company and partnership. LLPs having a capital amount less than 25 lakhs and turnover below 40 lakhs per year do not require any formal audits. It can own or acquire property because it recognize as a juristic person and Partners of Limited Liability Partnership cannot claim the property as theirs. It also gives way for the partners to organize their internal structure like a traditional partnership. A limited liability partnership is liable for the full extent of its assets. Hence, LLP Company is a hybrid between a company and a partnership.

SECTION 8 & SECTION 25 COMPANY REGISTRATION

A Section 8 Company is the same as Section 25 Company under the old Companies Act, 1956. Section 8 company registration is one of the most familiar forms of Non- Profit Organizations. It can be entrenched for “boosting commerce, science, sports, research, social welfare, arts, religion, charity, education, safe- guarding of environment or any such other object”, provided it “intends to apply their profits, if any, or other kind of income in boosting its objects” and “intends to prohibit the payment of any dividend to its members.” To make a section 8 company registration in Bangalore, the method is similar like incorporating other companies. Many entrepreneurs, both reputation holders and beginners, have felt an attractiveness toward philanthropy. These may look to found religious or otherwise socially responsible companies dedicated to promoting the welfare of all. Social entrepreneurship is almost a separate course in many kind of business schools.

Aditionally, it is a good thing to give a man a bread, as it enables him to feed his stomach for a day, a better thing to teach him to make a bread, as this teaches him a skill with which to provide himself a livelihood, but a great thing to so much educate, train and impart knowledge and skills about a bread making business to an illiterate and uneducated man, as to enable him not only to perform a valuable trade but to generate an operation that gives employment to several hundreds or thousands of people. Also, SSI– small scale industry company registration and MSME– micro, small and medium enterprises plays a vital role in the economic development of our nation.

SOLE PROPRIETORSHIP COMPANY

The Sole proprietor firm – 60-70% Legal entity in India. The sole proprietorship is a popular business form due to its simplicity, easy setup, and average cost. A solo proprietor needs to register only his or her name and secure local licenses, and the sole proprietor is ready for the business. A distinct disadvantage is that the owner of a sole proprietorship remains personally liable for all the business’s debts. Even, the trust formation registration and the society formation registration is a kind of non-profitable registration services.

And so, if a sole proprietor business functions in financial trouble, the creditors can deliver lawsuits against the business owner. If such suits are fortunate, the proprietor will have to pay the business debts with his or her own amount. As a sole proprietor, one must also file a Schedule SE with Form 1040. There is no need to pay unemployment tax on self, although one must pay unemployment tax on any employees of the business.

CONCLUSION

Some company allied registration services like secretarial service, import and export code creation, TDS filing- (tax deducted at source), are also applicable as a sub service in the company registration services.

“Every professional was once an amateur; every expert was a beginner in the beginning; So, Dream big and start your company now.”

“Let your trade plans be impenetrable and dark as night, but when you start your business, fall like a thunderbolt and shock your competitors!”