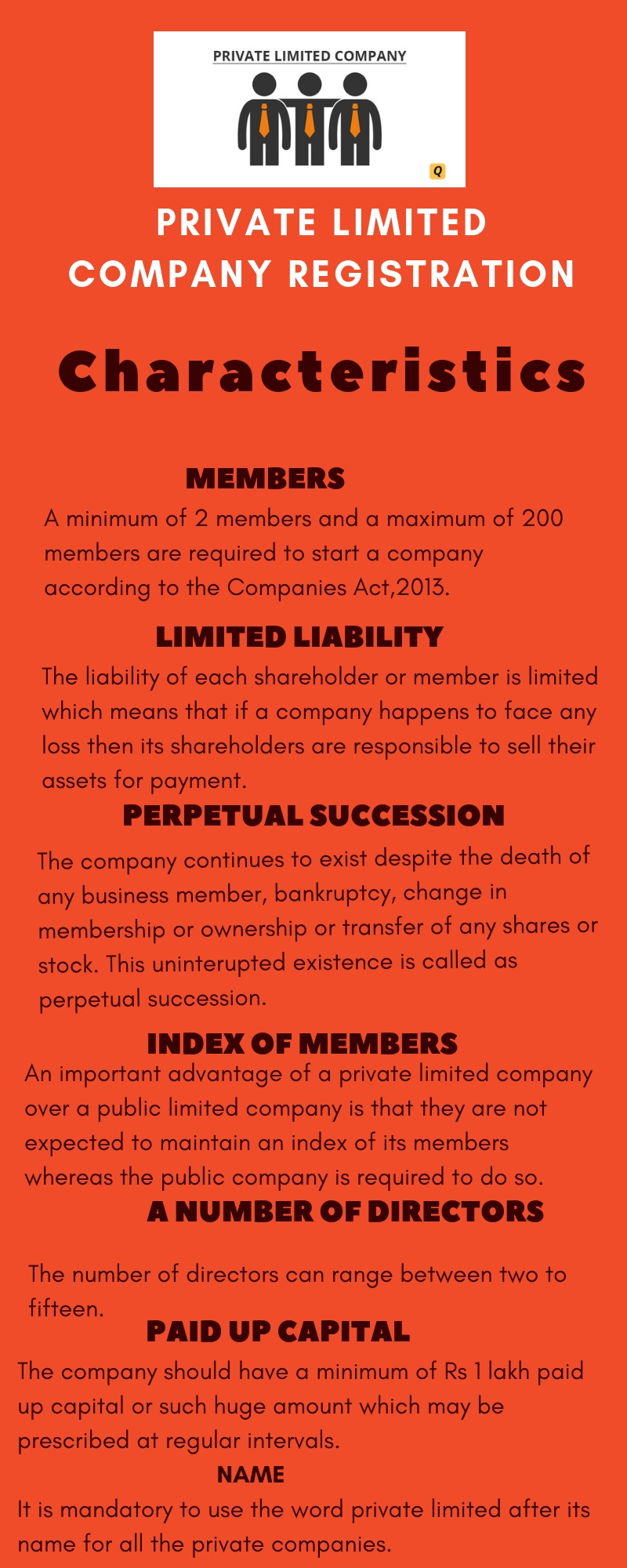

Private limited company

A private limited company implies a company, which has a base paid-up capital as might be endorsed, and its articles:

a)restricts the privilege to exchange its offers, assuming any;

b)limits the quantity of its individuals to fifty excluding

i)persons who, are in the company’s employment; and

ii)persons who, having been once in the past in the employment of the company, were members of the company while in that company stopped;

c)prohibits any welcome to general society to buy in for any offers in, or debentures of, the company; and

d)prohibits any welcome or acknowledgment of deposits from people other than its members, directors or their relatives.

Given that where at least two people hold at least one offers in a company together, they will, with the end goal of this definition be, treated as a solitary member.It must be noticed that it is the main number of members that is restricted to fifty. A private limited company may issue debentures to any number of people, the main condition being that a invitation to general society to subscribe for debentures is disallowed.

The earlier reference of private limited company decides the repressions, confinements and dissents, which must be expressly given in the articles of association of a private limited company. Segment 26 of the Companies Act, given that a private compelled ought to on a very basic level have articles of its own. Segment 27 gives that by virtue of a private limited company having share capital, the articles must contain the issues decided in sub section (b) and (c) of the clause of Section 3.The Articles of Association of a private limited company ought to contain at least one prohibition for any welcome or acknowledgment of deposits from people other than its members, directors or their relatives. Concerning the necessity of least paid-up capital of one lakh rupees for a private limited company, sub-section(3) of Section 3 of the Act had given two years time frame, from the day the Amendment (Act) of 2000 came into power to the existing companies inside which they were required to upgrade their paid up capital to the minimum required level. The Government is engaged to endorse a higher least paid-up capital whenever.

It was additionally stipulated that if any company neglects to improve its paid-up capital to the minimum level as required, it will be regarded to be a dead company inside the importance of Section 560 of the Act and its name will be struck off from the register of companies kept and maintained up at the workplace of Registrar of Companies.

The words ‘Private Limited’ must be included toward the finish of its name by a private limited company. Segment 12 of the Act stipulates that any at least two people related for any legitimate reason may, by subscribing in their names to a Memorandum of Association and generally conforming to the prerequisites of the Act in regard of company registration, form a registered company, with or without constrained obligation. Section 252 further sets out that a private limited company will have somewhere around two directors. The main two members may likewise be the main two directors of a private limited company.

The Directors must exercise their capacity to decline to register a move in regard of a private limited business in compliance with common decency and to support a company and as per its articles. The power must not be practiced for some incidental reason.

A private limited company which is a backup organization of a public company has gone under the extent of a public company from the beginning of the Companies (Amendment) Act, 2000, according to the changed meaning of the expression “Public Company” under Section 3 of the Act.

Prior to the Companies (Amendment) Act, 2000 a private limited company could turn into a considered public company on criteria like turnover, shareholding of or by different bodies corporate and so forth under Section 43A of the Act.

The Companies (Amendment) Act 2000 made the arrangements of Section 43A identifying with esteemed public company, inapplicable aside from Sub-section (2A) which gives that a considered public company which needed to change over into a private limited company (as it had prior changed over from private limited company to regarded public company), will advise the Registrar, immediately, the Registrar will make the fundamental modifications in the certificate of company registration and its memorandum of association alongside substituting the words ‘private limited company’ for the words ‘public company’, inside about a month from the date of application made by the company to the concerned Registrar of companies.

The Companies Act, 1956, gives certain benefits on private limited companies. Such companies are likewise exempted from following many arrangements of the Act. The essential reason behind this is since the private limited companies are controlled from welcoming capital and deposits from the general population, very little open intrigue is associated with their undertakings when contrasted with public limited companies.

The private limited companies lose these benefits and exceptions the minute they stop to be private limited company. A private limited company, which is a backup of an public limited company, is a public limited company as per the corrected meaning of public company under Section 3 of the Act. Thus, if a private limited company which was a considered public limited company under the arrangements of Section 43A of the Act at the very latest 13-12-2000 chooses to end up a private limited company, it needs to make strides gave in Sub-section (2A) of Section 43A of the Act.

Special obligations of a private limited company

In addition to the restrictions imposed on private companies as contained in Section 3(1) (iii) of the Companies Act, a private company owes certain special obligations as compared to a public limited company, which are as follows:

1.A private company, while filing its annual return with the Registrar of companies as required by Section 159, must also send with this return a certificate stating that the company has not, since the date of last return issued any invitation to the public to subscribe for its shares or debentures of the company and that where the annual return discloses the fact that the number of members of the company exceeds fifty, the excess comprises wholly of persons who under sub-clause (b) of clause (iii)of the sub-section (1) of the Section 3 are not to be included in reckoning the number of fifty.

2.Unless the articles otherwise provide, a member of a private limited company cannot appoint more than one proxy to attend and vote at a meeting of the company.

Consequences of infringement of the Articles of Private companies

Section 43 sets out that if a private limited company submits a default in following any of the obligatory arrangements required to be contained in its articles as required under Section 3(1) (iii) it will stop to be a private limited company and the Act will apply to the company as though it were not a private limited company.

The arrangements to area 43, in any case, expresses that if the infringement of any of the four conditions contained in the articles was coincidental or because of inadvertance or because of some other adequate reason, and if the Company Law Board is fulfilled that it is simply and fair to allow help it might soothe the company from the above results, on such terms and conditions as appear to be simply and convenient to the Company Law Board, on the utilization of the company or of some other intrigued individual.

The consequences which arise on account of infringing the minimum number of members in the case of private limited company are as under:

a)Section 45: Several liability of members under section 45, the members of a private limited company will lose their liability if, in the normal circumstances, their number falls below 2 and the company carries on business for a period of more than six months from the date of such reduction.

b)Section 433(d): Company winding up: This section states that the reduction of members below 2 in the case of private limited company is a valid ground for compulsory winding up.

c)Section 439 (4)(a): Contributory’s petition: This section states that a contributory may present a petition for winding up of a private company if the number falls below two.

Earnlogic, one of the leading company registration consultants in Bangalore can help you in registering your company.For more details visit earnlogic.