The Goods and Services Tax (GST) is a circuitous expense—tax collection is demanded on the stock of labor and products and is at last paid by the purchaser. The Government of India presented the GST in 2017 under their “one country, one expense” change. It is a solitary expense imposed on the inventory of labor and products directly from the producer to the shopper and basically replaces various circuitous assessments. The fundamental target of the change was to join various sorts of duties in the ambit of a solitary expense framework. In this blog I have discussed about 5 things you need to know about the GST.

-

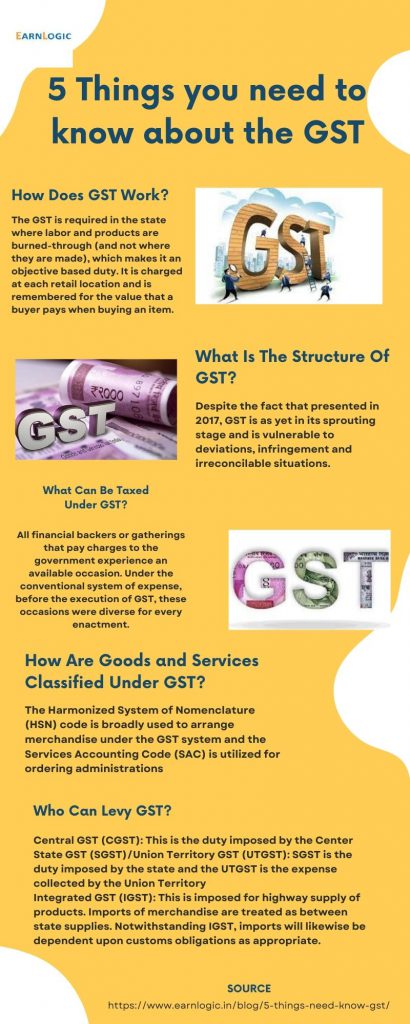

How Does GST Work?

The GST is required in the state where labor and products are burned-through (and not where they are made), which makes it an objective based duty. It is charged at each retail location and is remembered for the value that a buyer pays when buying an item.

a. In straightforward words, GST functions as a swap for quite some time charges imposed by the central and state government, making India a brought together market.

b. Certain labor and products are absolved from GST and they are rather exposed to a state’s current imposes, for example, the worth added charge (VAT)– an assessment paid at each stage of notable worth option in the inventory network. These duties are paid at each stage of the creation interaction by the customer.

c. GST on petrol rough, rapid diesel, engine soul, petroleum gas and avionics turbine fuel have been deferred and are as of now covered under the Center’s extract obligations and VAT.

d. GST offers both public and worldwide advantages:

Broadly, it facilitates the work of the maker by clubbing distinctive charges into one and lifts financial unification.

Universally, it carries India at standard with the worldwide market by observing an all around acknowledged assessment system.

GST accompanies specific relaxations and exclusions that one can benefit after the satisfaction of fundamental rules. An illustration of this motivator is tax reduction, which is the sum that specific citizens have the freedom to eliminate from the expense they owe.

2. What Is The Structure Of GST?

All labor and products are principally isolated into a four-level rate design of 5%, 12%, 18% and 28% now.

The government is thinking about changing the four-chunk design to one or the other three or two levels to make the tax assessment process smoother. Despite the fact that presented in 2017, GST is as yet in its sprouting stage and is vulnerable to deviations, infringement and irreconcilable situations. To stay away from this, the specialists delivered an Advanced Ruling Mechanism on issues of supply of labor and products. Citizens can allude to this instrument for issues like enrollment, arrangement, charge rate, taxability, and so forth

-

What Can Be Taxed Under GST?

All financial backers or gatherings that pay charges to the government experience an available occasion. Under the conventional system of expense, before the execution of GST, these occasions were diverse for every enactment. Notwithstanding, after 2017, there was a critical change in the assurance of the available occasion, wherein “supply” of a specific products or administration turned into the middle point for requiring charges.

The meaning of ‘supply’ is very wide and covers all types of supply with not many exemptions and prohibitions. Supply under GST incorporates deal, move, deal, trade, license, rent or removals of labor and products. For example, certain fundamental things are excluded from the GST and some draw in an extra cess, like negative mark products and extravagance things. Certain valuable metals (like gold) and exceptional stones draw in extra GST rates, aside from the ordinary material.

-

How Are Goods and Services Classified Under GST?

To arrange exchanged items, a universally normalized arrangement of numbers and names was created. The Harmonized System of Nomenclature (HSN) code is broadly used to arrange merchandise under the GST system and the Services Accounting Code (SAC) is utilized for ordering administrations.

-

Who Can Levy GST?

Since GST is an objective based assessment, the Center and States can demand it on a typical duty base. Accordingly, it has different parts:

Central GST (CGST): This is the duty imposed by the Center

State GST (SGST)/Union Territory GST (UTGST): SGST is the duty imposed by the state and the UTGST is the expense collected by the Union Territory

Integrated GST (IGST): This is imposed for highway supply of products. Imports of merchandise are treated as between state supplies. Notwithstanding IGST, imports will likewise be dependent upon customs obligations as appropriate.

Special cases:

GST has a double design wherein both the Center and the states have the ability to all the while demand the assessment on supply of labor and products.

The Center can force and control CGST and IGST, however the state or the Union Territory has the ability to require SGST/UGST.

GST isn’t material on product and supply of merchandise made to Special Economic Zones (known as zero-evaluated supply). For extraordinary situations like these, exporters can either guarantee an IGST discount or can trade products under a bond without paying the IGST.

Separate arrangements for labor and products have been joined under GST law to decide the idea of supply. The area of the provider and the spot of supply of labor and products decide if the exchange is intra-or between state supply.

Since the time its presentation in 2017, the GST rates have been reexamined a couple of times. As referenced over, the material GST rates have been grouped into a four-level rate structure. For example, considering the continuous COVID-19 pandemic, the GST rates on two meds were briefly taken out, while GST rates were diminished on as numerous other 15 fundamental things.

Latest news

India’s labor and products charge (GST) income gathered for the period of October is second most noteworthy since execution of the expense system in 2017, an authority discharge by the service of money said on Monday Nov 1 2021.

GST assortment for October remained at Rs 1,30,127 crore. The government had recorded things its most elevated ever assortment of GST in April 2021 at Rs 1,41,384 crore.

The incomes for October are 24% higher than the GST incomes around the same time last year and 36 percent more than 2019-20.

It further noticed that the incomes were likewise things supported because of the endeavors of the state and Central duty organization bringing about expanded consistence over earlier months.